We put data at the heart of your decision making processes.

We put data at the heart of your decision making processes.

All your data, one-stop service

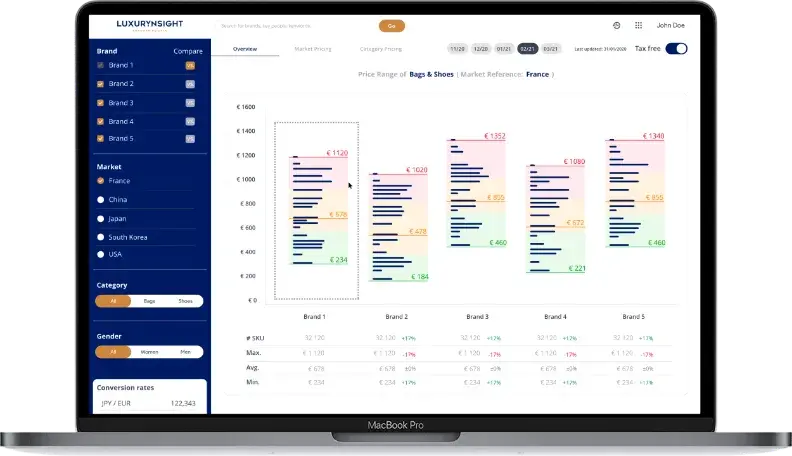

Including live currency exchange and tax

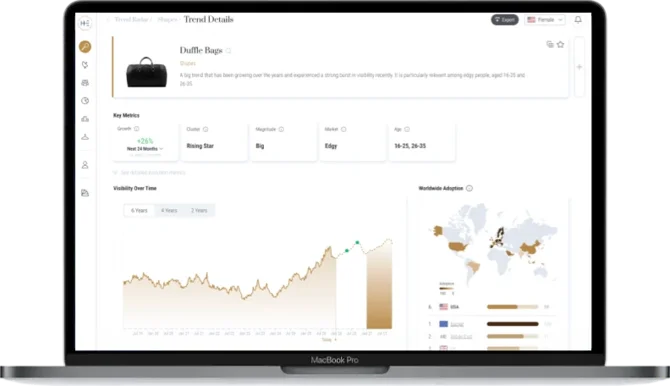

24-month AI prediction on 2.000+ fashion attributes with 91% accuracy

Monitor 500k stores worldwide in real-time

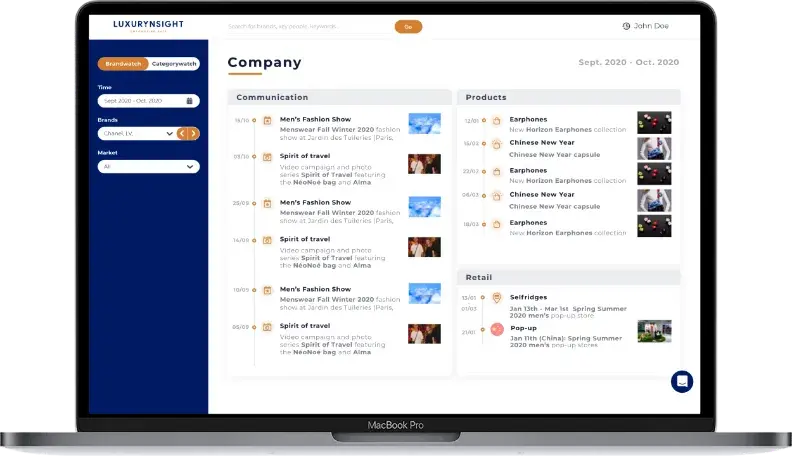

Monitor all new products, communication and distribution activations

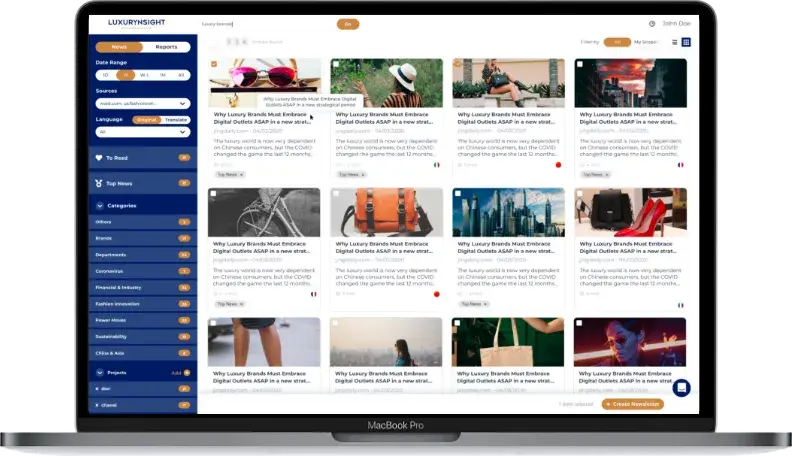

News & reports from 2000+ sources

Diverse industry expertise

International Team

Benchmark your CNY strategy against Valentino, Fendi, Lancôme, COS and more. Luxurynsight's 2026 report delivers the competitive intelligence your brand needs.

Explore our 2025 Global Luxury Brandwatch Report — analysis of 70+ brands and 10,000 activations revealing key trends reshaping the luxury industry.

Heuritech unveils its Fall/Winter 2026/2027 menswear analysis, highlighting the rise of romantic characters, intellectual aesthetics, surrealism, and sport-infused tailoring across Milan and Florence.

On February 25th, Luxurynsight hosted a webinar to reveal Global Luxury Brand Analysis 2025. In a replay, explore key trends across fashion, beauty, jewelry & lifestyle to refine your strategy in the webinar replay.

At Première Vision Paris February 2026, Heuritech unveiled exclusive SS27 trend forecasting guidelines, combining AI-powered consumer insights with industry expertise.

Vogue Business highlights Heuritech’s AI-powered insights on Fall/Winter 2026 womenswear trends, from opulent romance and lace to sportsmart silhouettes and evolving brown hues.

Jonathan Siboni, CEO of Luxurynsight, speaks at the Journal du Luxe’s Live Intelligence Webinar Series “Prévisions 2026”, exploring pricing discipline, customer value, and the new era of mature luxury.

Reuters features Luxurynsight’s insights on how luxury brands are leveraging the Milano Cortina 2026 Winter Olympics as a global cultural and strategic platform.

Marie Claire spotlights Heuritech’s insights on Gen Z fashion trends for 2026, highlighting the shift toward longevity, modern uniforms, and expressive statement accessories.

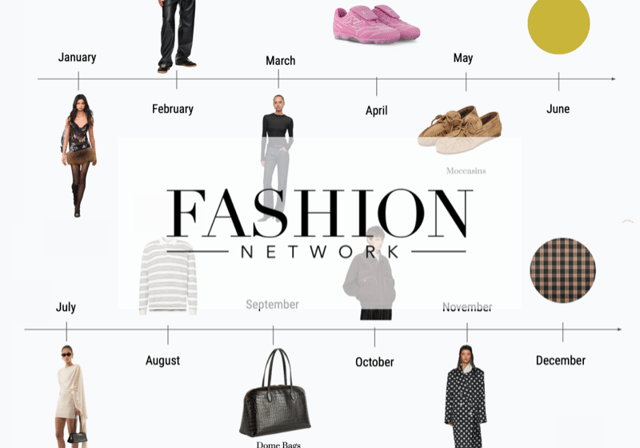

Heuritech unveils a 2026 fashion trend calendar, highlighting sustainability, texture, sculptural volumes and high-impact statement pieces powered by AI-driven insights.

Sourcing Journal spotlights Heuritech’s latest data revealing a 20% surge in consumer interest in checks, as plaid dominates street style at Pitti Uomo 109 in Florence.

A curated overview of the most important luxury, fashion, beauty, retail, and consumer outlooks shaping 2026. Explore key reports, data points, and strategic signals for the year ahead.