Chanel’s New Luxury Playbook: Scaling Back Prices, Investing in Brand Strength

www.glossy.coChanel is entering a new chapter as it scales back its aggressive price hikes in favor of long-term brand equity investments, as covered in a detailed piece by Glossy's Zofia Zwieglinska.

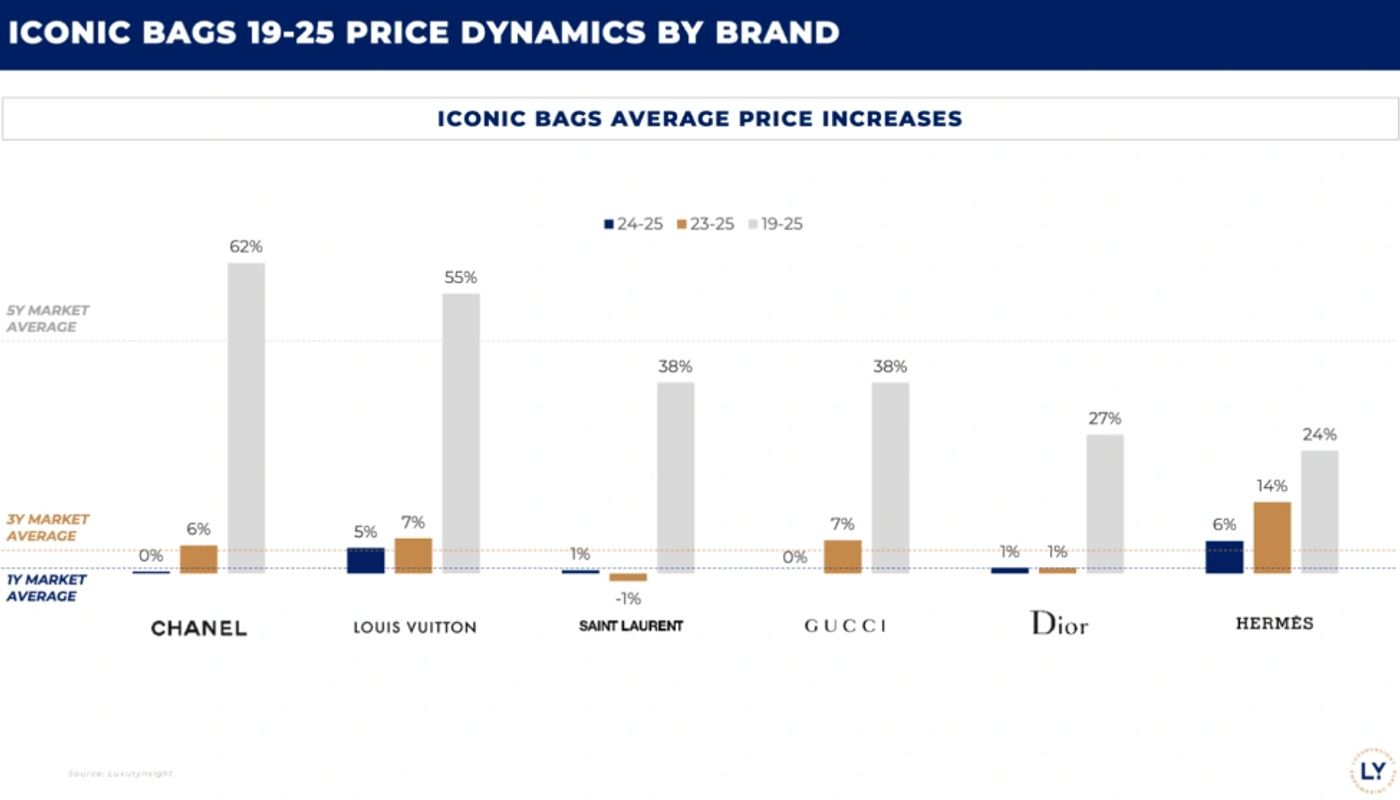

After raising prices by a staggering 59% from 2020 to 2023, Chanel implemented a much more modest 3% increase in 2024. This shift comes in response to a cooling luxury market, increased consumer resistance, and a 7% drop in sales volume. Bernstein analysts highlighted growing 'value for money' concerns among Chanel’s clientele, especially in key markets like China and the U.S.

Instead of leaning further into price as a proxy for prestige, Chanel is now prioritizing strategic brand investments: from expanding its boutique network in emerging markets to deepening control of its supply chain and bolstering craftsmanship. This move underscores the brand’s commitment to authenticity and long-term value creation rather than short-term gains.

The article also references pricing intelligence from Luxurynsight, spotlighting the platform’s role in tracking luxury market dynamics and helping to contextualize Chanel’s pricing decisions:

Want the full story? Dive into the article on Glossy.com for deeper insights into Chanel’s evolving strategy.

Special thanks to journalist Zofia Zwieglinska for the thoughtful mention of Luxurynsight in this important luxury industry analysis.